Ready to Start Trading?

Open a Live or Demo account online in just a few minutes and start trading on Forex and other markets.

Apply onlineAny Questions?

Contact us:

phone: +1 849 9370815

email: sales@tradersway.com

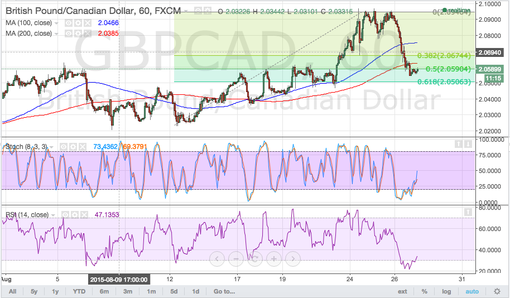

GBPCAD Pullback to 200 SMA (Aug 27, 2015)

GBPCAD is currently making a correction to the broken resistance around the 2.0600 major psychological support, which lines up with the 200 SMA on the 1-hour time frame.

The short-term 100 SMA is still above the 200 SMA so it’s likely that the uptrend could carry on.

In addition, price is finding support at the 50% Fibonacci retracement level while stochastic is moving up from the oversold area. RSI has formed a bullish divergence, creating lower lows while price made higher lows.

A bounce off the 2.0600 handle could lead to a move up to the previous highs around the 2.0950 minor psychological resistance and beyond. However, a break below the 61.8% Fib could mean that a longer-term correction is taking place and that price could head to the next area of interest around 2.0200-2.0300.

Event risks for this trade setup include the release of the UK second GDP estimate and quarterly business investment data tomorrow. No revisions are expected for the initial 0.7% growth estimate, although any surprise upgrades or downgrades could push the pound around. Business investment could show 1.6% growth for Q2, lower than the previous 2.0% increase.

As for the Canadian dollar, oil price movements are likely to be the biggest influence for Loonie forex direction in the next few days. Crude oil saw a slight rebound yesterday due to the US inventories report which showed a 5.5 million reduction in barrels instead of the projected gain of 1 million.

So far, the risk-off market environment isn’t doing the Loonie any favors for now, as traders continue to price in further contraction in Canada’s energy sector due to the downturn in commodity demand. Both the OPEC and US shale oil producers have declined to reduce production, leading to a supply glut that could push prices much lower.

By Kate Curtis from Trader's Way

Any Questions?

Email Us: sales@tradersway.com