Ready to Start Trading?

Open a Live or Demo account online in just a few minutes and start trading on Forex and other markets.

Apply onlineAny Questions?

Contact us:

phone: +1 849 9370815

email: sales@tradersway.com

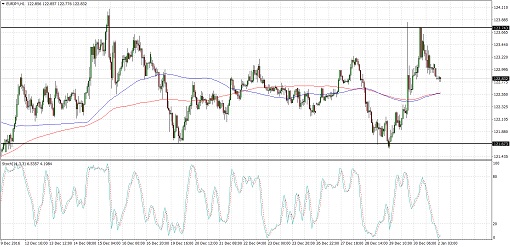

EURJPY Range Setup (Jan 02, 2017)

EURJPY has been trading sideways recently, finding support at the 121.70 area and resistance at 123.75.

Price just bounced off the resistance and is on its way towards support or at least until the middle of the range where the moving averages are located.

The 100 SMA seems to be crossing above the longer-term 200 SMA to indicate that the path of least resistance is to the upside. This means that EURJPY could bounce off the mid-channel area of interest at 122.50 before heading back up to the resistance.

Stochastic is in the oversold area and is starting to turn higher, possibly indicating a return in bullish pressure. If buyers are strong enough, they could push for a break of the ceiling and a rally of around 200 pips or the same height as the range formation.

Final manufacturing PMI readings are due from the top euro zone economies today and strong improvements could lead to more gains for the shared currency. Not much gains are expected from Germany and France, but Spain and Italy could show increases.

Japanese banks are closed for the holiday so the thin liquidity could limit any moves from yen pairs. Then again, this low liquidity environment could be grounds for volatile action if there are strong catalysts.

Japanese banks will still be closed tomorrow so this situation could persist until then, leaving yen pairs sensitive to market sentiment. Over the weekend, China reported a dip in their manufacturing and non-manufacturing PMIs so risk appetite could be weak.

By Kate Curtis from Trader's Way

Any Questions?

Email Us: sales@tradersway.com