Ready to Start Trading?

Open a Live or Demo account online in just a few minutes and start trading on Forex and other markets.

Apply onlineAny Questions?

Contact us:

phone: +1 849 9370815

email: sales@tradersway.com

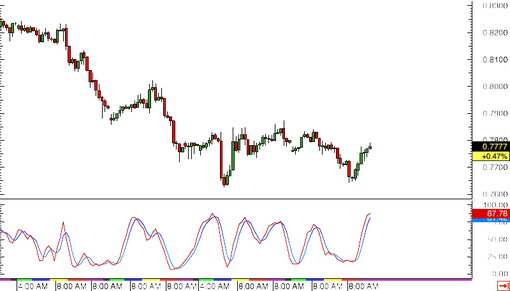

AUDUSD Double Bottom (Feb 13, 2015)

AUDUSD could be in for a strong long-term reversal, as price appears to be forming a double bottom pattern on its 4-hour chart.

As you can see, price bounced a couple of times off the .7700 major psychological support and is on its way to test the neckline around .7850.

A break past the neckline resistance might mean a move up to the .8000 major psychological resistance, as this would mark a 150-pip climb – the same height as the chart pattern. On the other hand, if the .7850 mark holds as resistance, price could make another move towards support at .7700 and create a triple bottom pattern.

Stochastic is still moving up, indicating that there’s enough buying pressure left to trigger a potential upside break. However, the oscillator is also nearing the overbought zone, which means that Aussie buyers might be getting exhausted.

Weaker than expected US retail sales data released in yesterday’s New York session led to a massive dollar selloff. This was enough for the Aussie to erase its losses during the earlier Asian session, as Australia printed weaker than expected jobs data then.

The pickup in risk appetite also seems to be supporting the Australian dollar, as commodity prices have also rebounded in the past week. Central bank easing has also carried the prospect of stronger global demand, which could keep higher-yielding currencies supported later on.

By Kate Curtis from Trader's Way

Any Questions?

Email Us: sales@tradersway.com