Ready to Start Trading?

Open a Live or Demo account online in just a few minutes and start trading on Forex and other markets.

Apply onlineAny Questions?

Contact us:

phone: +1 849 9370815

email: sales@tradersway.com

NZDUSD Short-Term Reversal (Sept 16, 2015)

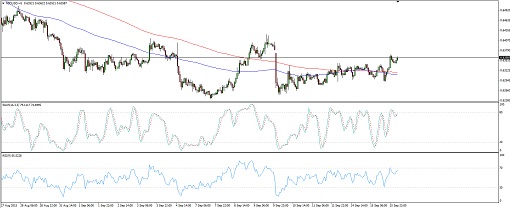

NZDUSD's recent downtrend might soon be over, as the pair is forming a double bottom reversal pattern on its 1-hour chart.

Price is still on its way to test the neckline of the formation at the .6400 resistance, with an upside break likely to push the pair up by an additional 250 pips or the same height as the chart pattern.

Both stochastic and RSI are moving up, hinting that there might be enough bullish momentum to trigger a test of the neckline. However, if this area holds as resistance, another move towards the bottoms at the .6250 minor psychological level might take place.

The 100 SMA is below the 200 SMA for now, also indicating that the path of least resistance is to the downside. If selling pressure is strong enough, a downside break of the .6250 floor might also be a possibility. On the other hand, an upward crossover from the moving averages might be an early signal that an uptrend is about to take place.

Earlier today, New Zealand reported a 16.5% gain in dairy prices during the recent Global Dairy Trade auction, suggesting that the industry is regaining ground. This marks the third consecutive bi-weekly auction that a gain in prices was recorded. The country's current account balance was also slightly better than expected at a deficit of 1.22 billion NZD versus the estimated 1.40 billion NZD shortfall.

Meanwhile, data from the US was weaker than expected, as the headline retail sales showed a mere 0.2% uptick instead of the projected 0.3% increase while the core retail sales report printed a 0.1% uptick instead of the estimated 0.2% gain. For today, the CPI figures are up for release and another round of disappointing results could mean more losses for the dollar.

Other event risks for this trade include the FOMC statement on Thursday during which Fed officials are expected to keep rates unchanged but provide some guidance on when the liftoff might take place. Downbeat remarks focusing on the uncertainties in the global economy could spur dollar weakness while reassuring comments could keep the currency afloat. Soon after, New Zealand is set to print its GDP reading for Q2 and might show a 0.5% expansion.

By Kate Curtis from Trader's Way

Any Questions?

Email Us: sales@tradersway.com